In 2023, President Lula da Silva enacted a turning point in Brazil's sports betting landscape by approving a new law that offers both online and land-based sports betting licenсes. The progress in this area builds upon the foundation laid in 2018 with the legalisation of sports betting under Law No. 13,756.

30 December 2023 is a milestone date in Brazil's gambling history. Namely, on this date, the President signed Bill 3.626/23 to officially become Law 14790. This law solidifies the legality of the sports betting and iGaming industries in the region.

President Lula's advocacy of these regulations reflects a strategic advancement. It presents a spectrum of opportunities for both local and international operators, ultimately contributing to the growth of the region's economy. As Brazil starts the implementation of these regulations from 1 January, 2025, its gambling sector is poised for a comprehensive and transformative evolution.

Given the positive landscape, let's dive deeper into the market, exploring the process of launching an online casino in Brazil and the crucial factors to bear in mind.

Is Online Gambling Legal in Brazil?

It took Brazil a number of decades to provide a clear and positive answer to this question, but now it's a legal 'yes'. As of today, sports betting and online gambling are officially authorised in Brazil.

What is Currently Known About Brazil's New Regulations?

All operators intending to operate in Brazil must apply for a 5-year licence at a cost of approximately 6 million euro. As for taxes, licensees are expected to pay a 12% charge on their Gross Gaming Revenue (GGR).

In order to obtain a licence, operators must establish a local presence. This includes the stipulation that a Brazilian national must hold at least a 20% ownership stake in the company.

A notable and perhaps unwelcome change is the introduction of a 15% tax on players' winnings.

To put it briefly, the new regulation marks a significant step for Brazil, aiming to make gambling safer, support social sectors, and attract investments. It's a positive change that has been anticipated globally for years, but the road to reach this point has been a convoluted one.

Let's have a closer look at the environment that has fostered the development of online gambling in Brazil.

In spite of Brazilians' cultural inclination to entertainment, the betting industry has faced a turbulent history. For the majority of the past 70 years, gambling has been illegal in the country, resulting in a halt to industry development. In 1946, a comprehensive ban took effect on all types of land-based gambling, which forced many establishments to close.

With the advent of the internet, it was generally accepted that iGaming was also subject to these restrictions. In recent years, Brazil has attempted to clarify the online gambling regulation and ban it officially several times.

One notable example appeared in 2010 when the Brazilian Congress attempted to pass a bill that would prohibit financial transactions at online gambling sites within the country. Similarly, in 2013, the Commission of Science, Technology, Innovation, Communication, and Computing (Comissão de Ciência, Tecnologia, Inovação, Comunicação e Informática (CTIC)) voted on a law project aimed at banning online gambling throughout Brazil.

For a long time, the gambling landscape in Brazil was limited to specific forms. There were only two forms of gambling allowed in the country: state-run lotteries and horserace betting. Despite the restrictions and the centralised authority, the initiative was still a significant step towards providing legitimate alternatives for Brazilians.

In terms of legality, poker occupies a relatively grey area. Since poker relies more on skill and less on luck, the game has been removed from the list of gambling activities. In response, the number of both online and offline poker rooms multiplied. However, the classification and status of poker within the realm of gambling were not clearly defined, since there was no clear law covering this particular activity.

Over the last few years, the iGaming world has closely watched the development of Brazil's regulatory framework, as there are a number of positive trends. One of the major changes in Brazil's status quo was achieved in 2016 with the Brazilian Gaming Congress, which attracted many entities interested in exploring and investing in the sector.

Online gambling regulation in Brazil turned a corner in 2018, when the government introduced a law that would create a single framework and unify the fragmented online gambling sector. Due to the impact of COVID-19 and the upcoming 2022 presidential election, the progress of this legislation was postponed. Nevertheless, in 2023, the President endorsed the bill, which now awaits congressional approval to achieve full legal status.

Despite delays in the regulatory processes, the Brazilian government remained committed to providing clarity and actively regulating the gambling industry. This effort was driven, among other things, by the goal of stimulating economic development in the region. For example, in September 2022, Brazil implemented a new law requiring the introduction of temporary lotteries. The funds raised were designated for healthcare and tourism purposes.

In conclusion, Brazil's federal structure presents both benefits and drawbacks for the online gambling industry. The issue of legality, which has long been a point of uncertainty, now has a clear resolution. This lucidity provides a solid basis for the anticipated growth and flourishing of the online betting sector in the region, as predicted by experts for the upcoming years.

Brazil Online Gambling Market Overview

With a population of 214.3 million, a 77.87% internet penetration rate, and the historic love of local citizens for various games of chance, the Brazilian online gambling market has a lot to offer international operators.

As far as the market size is concerned, the outlook is more than just positive. According to Statista, Brazil's online gambling market will grow at a compound annual growth rate of 18.82% and reach EUR 3 billion by 2027. Their recent regulation establishment supports the prediction and promises even more explosive growth.

There are several social aspects that will assist iGaming operators in developing a solid grasp of today's gambling in Brazil. Simply put, Brazilians are among the most tolerant audiences for online gambling. Brazil's competitive nature, love for football, and desire to have fun explain why the market is so promising.

In terms of the motivation for sports betting, which is the most popular form of gambling in the region, 60% of bettors cite entertainment or recreation as their reason for participating. Sports betting is viewed as a means of socialising with friends by 13% of respondents, while 12% see gambling as a direct source of income, putting them at risk of responsible gambling.

Payment Processing for Online Gambling

As in any market, payment processing poses a significant challenge for iGaming operators in Latin America (LatAm). The majority of payment systems are under government control, adding complexity to the endeavour of starting a casino in Brazil. Additionally, cash-based payment options remain highly popular among the public (54% for digital payment methods and 46% for cash, according to market research and data provided by international consulting firms in Latin America).

Which payment systems are a must-have for entry into the Brazilian market?

- Pix. Developed by the Central Bank of Brazil, the Pix system facilitates real-time payment transactions and transfers. This system has gained widespread adoption due to its convenience and accessibility, significantly transforming the country's payment landscape and reducing dependence on traditional banking methods.

- Boleto. Boleto is a local voucher system managed by the Central Bank of Brazil and has been in use since 1993. It remains a primary payment option, especially for Brazilians without credit cards. However, Boleto payments are often slow, taking several days to process and limited to bank operating hours.

- Electronic wallets. Including highly popular options like Pay4Fun and Evino in the list of payment methods will enhance user convenience.

- Debit and credit cards. With increasing digitisation and globalisation, this type of online payment is building up its influence in Brazil. It is important to accept both global payment providers like Visa and Mastercard, as well as local credit cards such as Hipercard and Elo.

It is important for operators to strengthen their anti-fraud efforts, considering the popularity of vouchers among the population. Betting vouchers can be purchased offline, making the process of betting anonymous and increasing the risk of fraudulent activities.

For example, vouchers have limitations on the speed at which payments can be processed: it can take up to three days on average, and players can exploit this delay to play with funds that don't belong to their account.

Crypto Gambling in Brazil

Another important point to note in relation to finance is crypto gambling. Despite the difficulties faced in 2022, leading cryptocurrencies have shown signs of recovery in their value. This positive trend applies to the online gambling sector as well.

According to a report from SOFTSWISS, which examines over 860 brands, the volume of crypto betting in Q1-Q3 2023 still accounts for nearly a third of Total Bets for the period. Bet Count data proves the point: with an impressive 50% growth in the number of bets, it appears that the use of cryptocurrencies within the online gambling community is pretty stable and trending upwards.

Looking closer at the preferences of the region's population, in 2021 alone, there were USD 38 billion worth of crypto purchases and sales in Brazil. Over the course of 2022, the Brazilian government and Congress engaged in discussions surrounding the regulation of cryptocurrencies. Just days before the end of the year, then-President Jair Bolsonaro signed the respective law, underlining the growing significance of cryptocurrencies in Brazil.

The escalating demand from the public and government towards cryptocurrencies highlights their relevance for consideration before entering the Brazilian market. Enriching your payment portfolio with cryptocurrencies will be in line with the evolving preferences and demands of Brazilian customers.

Languages

As an international language, English is obviously a win-win option to use for launching an online casino anywhere in the world. However, localisation is setting its own rules in 2023 – in local markets, it's essential to make an extra effort and provide players with the most familiar interface.

For example, it is worth considering a site in Portuguese for Brazil since 98% of the population identifies it as their native language. With multiple locales, an online casino can expand its local target audience and make the player experience streamlined and enjoyable.

Starting a Casino in Brazil: Software Requirements

The software for an online casino targeting Brazilian players should meet several important requirements besides regular ones, such as security, simple and flexible administration, an effective affiliate management system, bonuses, and payments. The last includes the previously mentioned payment options, as well as crypto processing, needed to gain a competitive advantage.

When expanding an online casino to the Brazilian market, scalability becomes a crucial factor to consider. One area of significant interest for the population is sports betting, which presents a great opportunity for business growth. Integrating a sportsbook into your online casino and offering a seamless user experience with a single wallet between casino and sports can significantly enhance the success of your venture in Brazil.

When establishing an online casino in Brazil, it's crucial to look to the future. The software ecosystem by SOFTSWISS is designed for swift entry into the Latin American market and is poised for future advancements.

The Casino Platform, featuring cryptocurrency support, a multilingual interface, and a robust back office, is an excellent choice for operators aiming to expand in Brazil. The platform seamlessly aligns with the SOFTSWISS Sportsbook, a software platform to launch a sports betting business online with distinctive bonuses.

In a competitive market, differentiation is key. To capture the attention of Brazilian players, the Game Aggregator, a hub offering 23,500 games from 270+ game providers, and the Jackpot Aggregator, a software system for launching and managing exclusive jackpots, assure maximum player engagement. The SOFTSWISS software product ecosystem is fully cross-compatible, empowering operators to create a tailored winning combination for their specific market.

Casino Game Preferences in the Brazilian Gambling Market

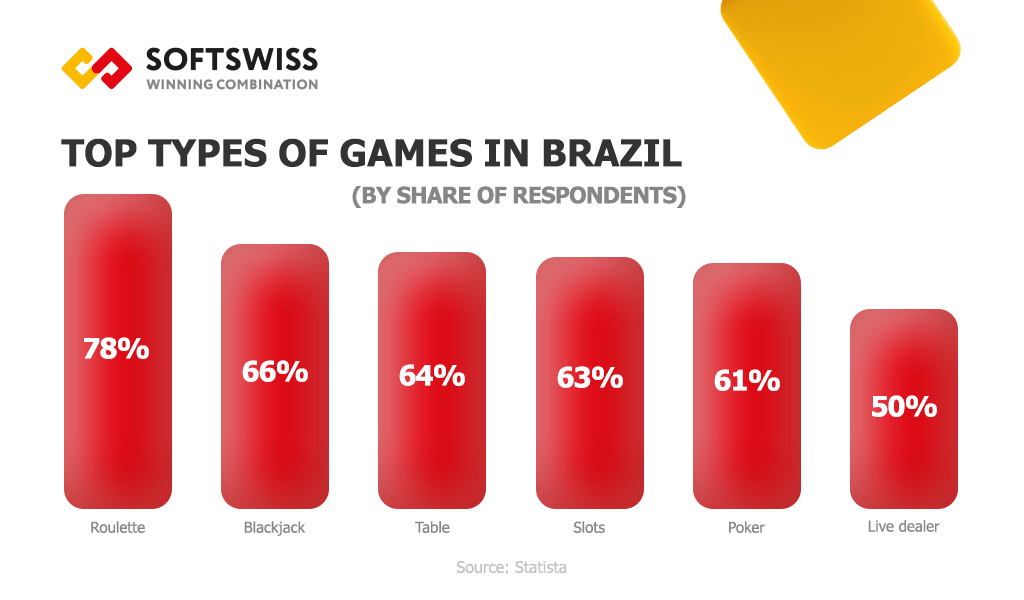

Brazilians love the game of chance and skills in all of its varieties, from sports betting, lottery, and bingo to the famous Jogo do Bicho. According to Statista, roulette is at the top of the list, a classic casino game that offers thrilling excitement and the chance to win big. Whether it's a European, American, or French version, Brazilians enjoy the thrill and strategy of placing their bets and watching the wheel spin.

Blackjack is another popular game among Brazilian online casino players. Table games generally hold a special third place in the hearts of Brazilian players. These activities offer a good mix of strategy and luck, allowing players to challenge themselves against the house or other players.

Slots, the eternal and unchanging leader of all the ranks, also have a significant following in the Brazilian online casino scene. Whether traditional three-reel fruit slots or modern video slots with multiple pay lines, Brazilians enjoy spinning the reels, eagerly waiting for a winning combination.

As previously discussed, poker owes part of its popularity to poor regulation of skill-based games, ranking fifth among Brazilian gambling activities.

Lastly, live dealer games have gained immense popularity among Brazilian online casino players. It comes as no surprise that socially active Brazilians are ready to engage in live online gaming and build a vibrant gaming community, as their sense of belonging knows no barriers, neither in real life nor online.

Sports Betting in Brazil

Before we move on to the marketing of online casinos in Brazil, let’s take a look at sports betting. Any operator considering entry into the Brazilian market ideally should recognise the need to seamlessly integrate both casino and sportsbook services under a single iGaming brand. This combination is particularly crucial in Brazil, given the population's passion for sports gambling.

Figures back up the hypothesis: according to the TGM Gambling and Sports Betting Survey, nearly one-third of the population bets on sports several times a week, while 8% bet daily. The fact that Brazil stands as the most populous country in the continent leads to a logical conclusion: the market for sports betting business development here is full of promise.

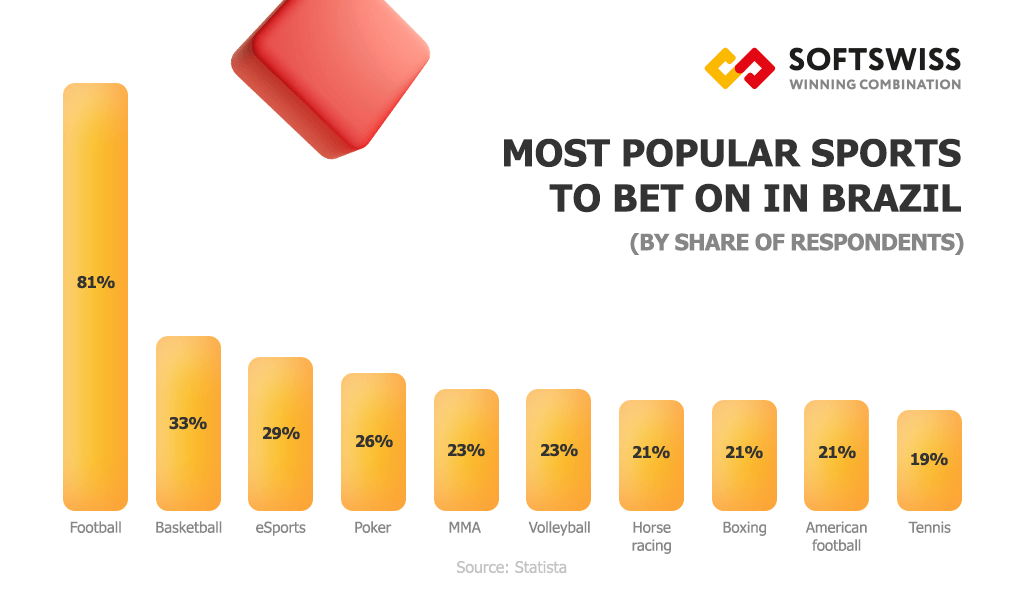

Identifying the optimal niche requires an analysis of Brazilian preferences. According to Statista's findings, football has a huge lead, accompanied by popular disciplines like basketball, poker, and horse racing.

Moreover, this is where the growing popularity of esports in Brazil enters the equation. Statista's report suggests that the user base for esports will exceed 24 million by 2027. This emerging market presents a valuable opportunity for bookmakers to tap into, expand their audience, and capture the attention of younger bettors. The SOFTSWISS Sportsbook Platform is now certified for Brazil, enabling operators to confidently enter the market with a solution that meets local regulatory standards.

Another great potential lies in offering innovative features and services to differentiate your sports betting website from competitors. When it comes to uniqueness and gamification, the SOFTSWISS Sportsbook team holds the top spot.

The sports betting management platform is equipped with four unique types of bonuses as well as jackpots, giving bookmakers the ability to cater to audiences in any market. By constantly staying updated with the latest trends, SOFTSWISS bookmakers provide an exceptional bettor experience and cultivate a loyal customer base.

Marketing to Start an Online Casino in Brazil

Since online gaming was a grey zone, open marketing methods such as Google Ads or TV promotion haven’t been an option so far. However, the new legislation has shed some light on the gambling advertisement landscape. Those with a licence can run ads to promote their website while following strict, responsible gambling guidelines. It includes warnings about betting risks, encouraging safe gaming, and avoiding claims about gambling's social benefits.

Despite these restrictions, it's still essential to find a nice balance between new advertising avenues that Brazil's market offers and effective, proven methods to keep your business flourishing and maximise its potential.

For now, an effective marketing strategy includes building a network of affiliates, placing info on the casino in reputable online resources, pay-per-click campaigns, and SEO.

A Sleeping Giant Awakens

Brazil is the jewel in the crown of Latin America, with enormous potential for development in online gambling. In view of the positive impacts of regulations implemented, it is evident that such measures can greatly improve the nation's financial stability, bolster essential sectors like healthcare, and drive overall economic growth.

Since 2018, the entire expert iGaming community has been waiting for the wind of change that will open Brazil to the legal online gambling business. With the new regulation law up and running, now is the best time to seize the opportunity and start preparing to enter this thriving market in order to take advantage of its endless prospects.